Middle East producers call for $200bn investment to meet Energy Dequimer

The Middle East’s natural sector will need $200bn of investment over the next four years to increase production by 30 percent and meet the urgent need for energy, the delegates at the Middle East Summit in Dubai.

The call comes as the region prepares for a sharp increase in human needs driven by population growth, industrialization, climate change, obesity and the rapid development of AI infrastructure.

More than 150 executives from oil and gas companies and international companies have been invited to discuss how to unlock the next phase of growth in the region’s energy industry.

Participants advocated accelerating investment in productive capacity to support economic diversification, reducing dependence on fossil fuels for energy production and a reliable, secure supply of carbon.

Development of Gas Sectors

The conference, organized by The Petroleum Economist in collaboration with Managing Sponsor Crescent Petroleum, brought together senior policy makers and executives from:

- Adnoc

- Aramco

- XRG

- Bapco Energy

- Rak gas

- Dana is electricity

- Something standing there

- A shell

Global financial institutions including Deutsche Bank, Cantor Fitzgerald and Fab are also participating, with a strong focus on natural gas projects.

Majid Jafar, CEO of Crescent Petroleum and Board Director of Dana Gas, said: “Our region is the second largest producer of natural gas in the world, after North America.

“Since 2020, gas production has increased by more than 15 percent, and it is expected to increase another 30 percent by 2030, which will require $ 200bn of investment.

“This is not the same as meeting energy needs. It is about creating new economic opportunities, driving industrial diversification, and promoting stronger regional ties.

“Gas will be critical to ensuring energy security, supporting industrial development, and enabling a clean energy transition.”

Power revolution

The delegates noted that gas producers in the regions will need to add 14khd of New Supply by 2030 – equivalent to all of Europe’s gas demand – to reach 86 BCFD.

The increase is expected to be further driven by the demand for AI, with server farms in the UAE and Saudi Arabia seeking intensive, reliable and cost-effective power.

Natural gas is viewed as an ENANGER due to competitive natural gas prices, modern infrastructure and available capital.

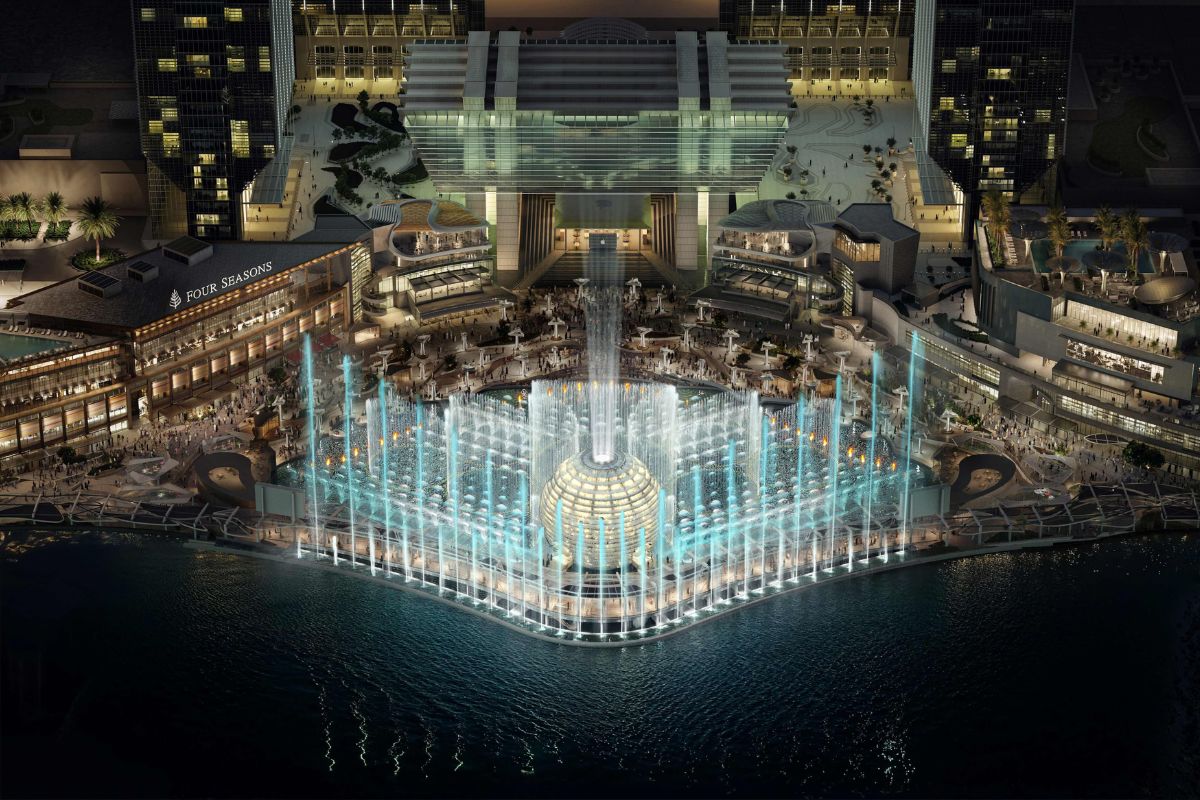

The event, held at the Waldorf Atororia Difc, featured keynote speeches from Musabbeh Al-Kaabi, CEO of Abdoc al-Ghamdi, Senior Vice President for Gas at Saudi Aramco.

Industry leaders emphasize the importance of strengthening relationships between producers, investors and governments, while promoting new investment models and strong regulatory frameworks to develop integrated networks, sustainable networks.

Middle East gas conference in Dubai

Abdulkarim Ghamdi, Senior President of Petro Gas at Saudi Aramco, said: “Today’s discussions emphasize that the most important infrastructure and industrial growth, as well as increasing the energy of the future.

“Delivering that possibility depends on a very close cooperation between governments, investors, and the Advisory Council of the Sectors helps to make it happen on the financial risk, strengthening the Bridge

Jassim Alshirawi, secretary general of the International Energy Forum (IEF), said: “As the world’s energy situation is emerging rapidly all the scenarios: The world will need more energy that is reliable, inexpensive and low-cost.

“This puts natural gas at the center of the global energy strategy. At Aramco, we are developing one of the 2021 gas production plans, which will lead to reaching almost 2021 million barrels.

“This growth is expected to generate $12-15bn in operating cash flows. Through cutting-edge technologies, leading technologies, unique partnerships, and strong partnerships, we are helping to build an energy system that works for all.”